what is the percentage of taxes taken out of a paycheck in colorado

Pay 205 on the amount between 48535 to 97069 or 30033. Pay 15 on the amount up to 48535 or 728025.

Create Pay Stubs Instantly Generate Check Stubs Form Pros

As an employer youre paying 6 of the first 7000 of each employees taxable income.

. All data was collected on and up to date as of Jan. Amount taken out of an average biweekly paycheck. Colorado Paycheck Quick Facts.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. If your taxable income was 50000 in 2020 you would calculate your federal tax as follows. Your employees get to sit this one out so dont withhold FUTA from their paychecks.

These are contributions that you make before any taxes are withheld from your paycheck. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The good news is that If you pay your state unemployment taxes in full and on time each quarter you can claim a tax credit of up to 54.

Average tax rate Total taxes paid Total taxable income. For self-employed individuals they have to pay the full percentage themselves. The wage base limit is 127200 meaning that only wages up to that amount are subject to the Social.

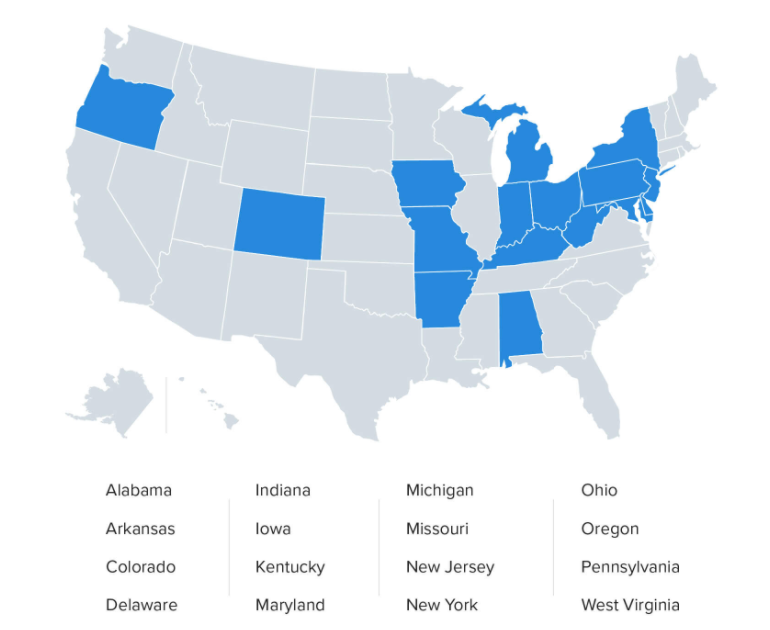

Colorado income tax rate. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Amount taken out of an average biweekly paycheck.

Its important to note that there are limits to the pre-tax contribution amounts. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Colorado Paycheck Quick Facts. Both employee and employer shares in paying these taxes each paying 765. Total income taxes paid.

Supports hourly salary income and multiple pay frequencies. Total tax burden and how much was taken out of a bi-weekly paycheck for each state. Total income taxes paid.

And Social Security taxes are only applied to the first 118500 in wages for the 2015 tax year which can make the effective Social Security tax rate less for higher-income individuals. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

The amount withheld per paycheck is 4150 divided by 26. This free easy to use payroll calculator will calculate your take home pay. For 2022 the limit for 401 k plans is 20500.

At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is assessed at 145 percent. Amount taken out of an average biweekly paycheck. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Switch to Colorado hourly calculator. Census Bureau Number of cities that have local income taxes. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Total income taxes paid. However you only pay half of this amount or 62 out of your paycheck the other half is paid by your employer. Colorado Salary Paycheck Calculator.

Total federal tax payable.

Colorado Inheritance Laws What You Should Know Smartasset

Prepare And Efile Your 2021 2022 Colorado State Tax Return

Tax Calculator Estimate Your Taxes And Refund For Free

How Much Tax Is Taken Out Of My Paycheck In New Brunswick Cubetoronto Com

Colorado Paycheck Calculator Smartasset

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Fort Collins Tax Preparation Services Planning By A Local Trusted Cpa

Matt Woolfolk Author At Colorado Springs Cpa Biggskofford Accounting Firm

Colorado Paycheck Calculator Smartasset

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Matt Woolfolk Author At Colorado Springs Cpa Biggskofford Accounting Firm

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Book Illustrator Salary In Colorado Springs Co Comparably

Cleaning Maid Salary In Colorado Springs Co Comparably

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting